tide.research

Outside of Tide Exchange, Tide is investing significant resources in seeking to bridge the gap between traditional finance and DeFi. Below are some of our initiatives that we are exploring.

July 2023 – Intern Notes [Real World Asset Tokenization – Mortgages]

Abstract:

This concept introduces the idea of real estate tokenization and its application in the Shared Ownership Mortgage Model. By leveraging blockchain technology, tokenization enables fractional ownership of real estate assets, enhancing liquidity, accessibility, and market efficiency. This concept explores the need for such innovation, supported by relevant research and industry insights.

Introduction:

The traditional real estate market faces challenges of illiquidity, high entry barriers, and limited accessibility. Real estate tokenization offers a transformative solution by digitizing real estate assets and enabling fractional ownership. This concept outlines the benefits of real estate tokenization and its role in the Shared Ownership Mortgage Model.

Need for Real Estate Tokenization:

Enhanced Liquidity:

Real estate tokenization leverages blockchain technology to represent real estate assets as digital tokens. These tokens can be easily traded on decentralized exchanges, enhancing liquidity in the market. Research conducted by Deloitte reveals that tokenization improves the liquidity and tradability of real estate assets within secondary markets (Deloitte, June 2022).

Accessibility and Inclusion:

High capital requirements often exclude many individuals from homeownership. Tokenization enables fractional ownership, making real estate investment accessible to a wider range of individuals, including retail investors. A study by Deloitte highlights that tokenization promotes financial inclusion and expands investment opportunities to a broader demographic (Deloitte, June 2022).

Efficiency and Cost Reduction:

The traditional real estate market involves intermediaries, complex paperwork, and high transaction costs. Tokenization streamlines the process by automating tasks, eliminating intermediaries, and reducing administrative burdens. Research conducted by PwC suggests that tokenization improves efficiency, reduces costs, and accelerates transaction settlement times (PwC, November 2021).

Benefits of Real Estate Tokenization:

Enhanced Liquidity and Diversification:

Fractional ownership through tokenization enables investors to diversify their portfolios by accessing a broader range of real estate assets. Liquidity is increased as tokens can be traded on digital platforms, allowing investors to buy or sell their ownership stakes more easily.

Transparency and Security:

Blockchain technology provides a transparent and tamper-proof record of transactions. Tokenization ensures transparent ownership records, reducing fraud and enhancing trust among stakeholders. A report by CB Insights highlights the enhanced security and immutability of blockchain-based transactions (CB Insights, March 2022).

Global Market Access:

Tokenization removes geographical barriers, enabling investors from around the world to participate in real estate investments. This global accessibility broadens the investor base, increases market liquidity, and potentially boosts property values. Research from ING Economics supports the notion that tokenization allows for global investment opportunities (ING Economics, April 2022).

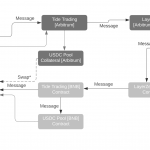

Shared Ownership Mortgage Model:

The Shared Ownership Mortgage Model inspired by similar schemes in the UK seeks to combine real estate tokenization and liquidity providers to address barriers to homeownership.

Fractional Ownership:

Tokenization enables fractional ownership, where investors can acquire smaller ownership stakes in properties. In the Shared Ownership Mortgage Model, homebuyers purchase a majority stake (51%) in the property, while liquidity providers hold the remaining minority stake (49%). This approach lowers the barrier to entry and enhances accessibility for aspiring homeowners.

Role of Liquidity Providers:

Liquidity providers, such as mortgage lenders, act as the mortgage lenders in the Shared Ownership Mortgage Model. They provide the necessary funds for homebuyers to acquire their majority ownership stake in the property. Liquidity providers benefit from increased yield and investment diversification by earning interest on the mortgage amount financed.

Integration with Blockchain:

Utilizing Blockchain:

The Shared Ownership Mortgage Model leverages blockchain to facilitate seamless transactions. Cryptocurrencies, such as stablecoins, can be used for mortgage payments, interest settlements, and property resale transactions. This integration enhances transaction speed, reduces costs, and ensures transparency in the mortgage process.

Smart Contracts and Decentralized Finance (DeFi):

Smart contracts, powered by blockchain technology, automate and enforce the terms of the mortgage agreement. These contracts ensure secure ownership transfers, automate interest calculations, and facilitate the distribution of shared property appreciation. Integration with decentralized finance (DeFi) platforms provides additional benefits to liquidity providers through innovative financial products such as liquidity pools and yield farming.

Regulatory Considerations and References:

Legal and Regulatory Compliance:

The implementation of the Shared Ownership Mortgage Model requires adherence to legal and regulatory frameworks. Collaboration with legal experts ensures compliance with property, mortgage, tax, and consumer protection laws. By working closely with regulatory bodies, the model can operate within a secure and regulated environment.

Industry Insights and Research:

References to industry insights and research studies support the need for the Shared Ownership Mortgage Model. These references highlight the challenges of high capital requirements and limited accessibility in the traditional mortgage market, as well as the potential of real estate tokenization and the benefits of involving liquidity providers.

References:

- Deloitte Research, “Tokenization of Real Estate: Unlocking liquidity, access, and value” (June 2022)

- CB Insights, “How Blockchain Is Transforming Real Estate Transactions” (March 2022)

- PwC Research, “Blockchain in Real Estate: How Technology is Changing the Industry” (November 2021)

- ING Economics Research, “Tokenization: Trend, Innovation, or Revolution?” (April 2022)